3 To complete your enrollment at our Secure Form Processing Site

................................................................

Welcome to the

Voluntary benefits ENROLLMENT

website

- You may enroll in any combination of coverages.

- Prefer Paper Enrollment?

- LIFE INSURANCE enrollment

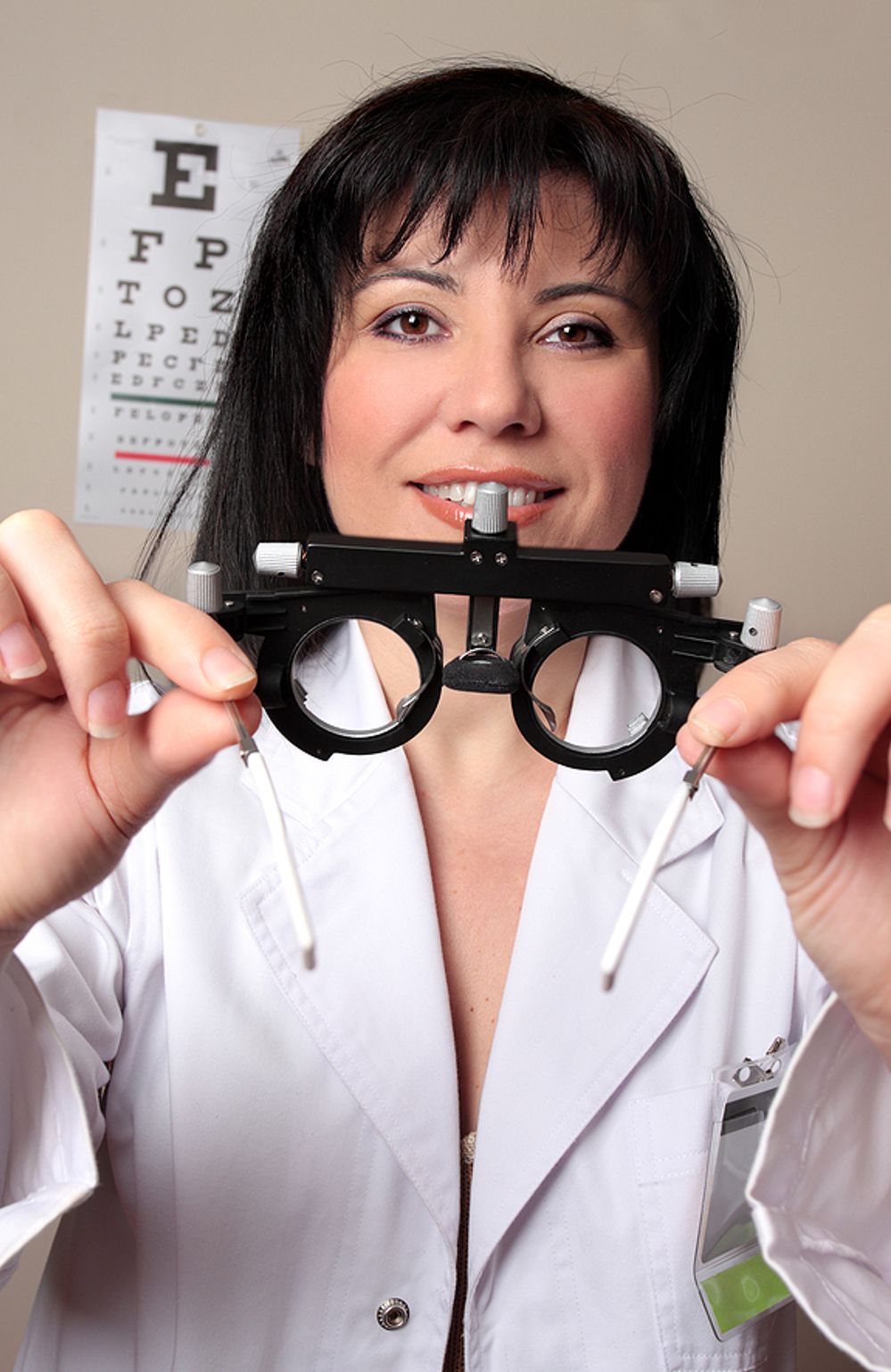

- VISION CARE enrollment

- SHORT TERM DISABILITY enrollment

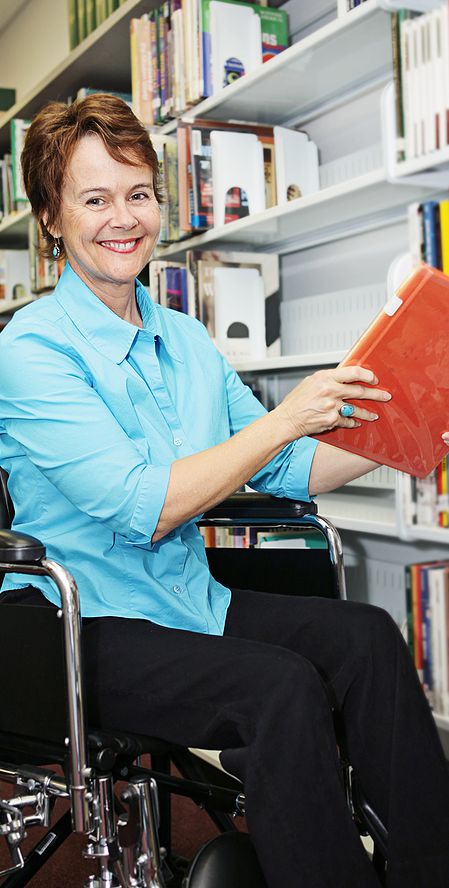

- LONG TERM DISABILITY enrollment

Benefit Under Age Age Age Age Age Age Age Age Age Age

Per Week Age 30 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75&Up

-------- ------ ----- ----- ----- ----- ----- ----- ----- ----- ----- -----

$ 100 $ 1.43 $ 1.76 $ 1.47 $ 1.84 $ 2.31 $ 3.00 $ 3.27 $ 3.49 $ 3.72 $ 3.99 $ 4.17

$ 200 2.86 2.58 2.95 3.69 4.62 6.00 6.55 6.99 7.45 7.98 8.34

$ 300 4.29 3.88 4.43 5.54 6.92 9.00 9.83 10.50 10.98 11.55 12.05

$ 400 5.72 5.17 5.91 7.38 9.23 12.00 13.11 13.67 14.55 14.89 15.44

$ 500 7.15 6.46 7.38 9.23 11.54 15.00 16.38 16.87 17.33 17.88 18.33

$ 600 8.58 7.75 8.86 11.08 13.85 18.00 19.66 19.99 20.34 20.67 20.89

$ 700 10.02 9.05 10.34 12.92 16.15 21.00 22.94 23.66 24.12 24.66 24.98

$ 800 10.73 9.69 11.08 13.85 17.31 22.50 24.58 24.93 25.39 25.79 26.88

$ 900 10.73 9.69 11.08 13.85 17.31 22.50 24.58 24.99 25.50 25.89 26.66 $1000 10.73 9.69 11.08 13.85 17.31 22.50 24.58 25.01 25.67 26.38 26.98 $1100 10.73 9.69 11.08 13.85 17.31 22.50 24.58 24.99 25.55 26.02 26.77 $1200 10.73 9.69 11.08 13.85 17.31 22.50 24.58 24.98 25.46 26.11 26.98

Vision

BI-WEEKLY PAYROLL DEDUCTION:

Employee only.........$ 3.37

Employee & Spouse.....$ 6.41

Employee & Children...$ 6.75

Employee & Family.....$ 9.78

EMPLOYEE -

SPOUSE -

CHILDREN -

You may purchase up to the lesser of 7 times your gross income, or $500,000. Coverage for spouse may be up to the lesser of half the employee amount or $150,000.

You may purchase 60% of your gross monthly income (up to $6,000/month).

You may purchase up to 66.7% (two thirds) of your gross weekly income.

Employee, spouse, and children under 26 are eligible.

- DENTAL INSURANCE enrollment

Employee, spouse, and children under 26 are eligible.

Your coverage will start on 1/1/2020, and payroll deductions will begin on the first pay period after the effective date. You will receive confirmation and benefit materials from Companion. Do not cancel any prior coverage until you have received notification of approval and issue.

2 Enter your name:

Short Term Disability BENEFIT FEATURES :

Vision Care BENEFIT FEATURES :

© Copyright 2012 Companion Life Insurance Company

P.O. Box 100102 | Columbia, SC 29202-3102

E N R O L L ?

E N R O L L ?

Life Insurance (including Accidental Death & Dismemberment)

BI-WEEKLY PAYROLL DEDUCTION

EMPLOYEE OR SPOUSE:

Short Term Disability

BI-WEEKLY PAYROLL DEDUCTION:

Pre-existing conditions: We will not cover a disability that begins in the first 24 months after the effective date of coverage. This applies of the disability results from a pre-existing condition with treatment (or symptoms for which an ordinarily prudent person would seek treatment) within 12 months prior to the effective date. This exclusion does not apply if the insured did not receive treatement for the condition for 6 consecutive mos. after the effective date.

Benefit Integration: These sources of income will reduce benefits: Social Security primary and dependent disability and retirement payments, other group insurance disability paymnets, Workers' Compensation or any federal or state sponsored program, income from employment and retirement, pension, sick leave or salary continuation plans.

- Benefits begin on the 1st day of disability for accident, 8th day for illness.

- Benefits continue while disabled for up to 26 weeks.

- Partial disability benefit included, supporting a recovering employee's return to part-time work.

- Premium is Waived in the event of disability.

- Maternity, alcoholism, drug addiction, and mental or nervous conditions are covered the same as any other illness.

- Includes a $10,000 Accidental Death and Dismemberment benefit for each insured employee.

- Enrollment Age "Freeze" -- When an employee enrolls for coverage, the premium payable for the selected coverage will always be based upon the employee's age at the time of original enrollment.

EMPLOYEE BENEFIT AMOUNT:

- May select from $100 to $1200 per week benefit, up to 66.7% (two thirds of your gross weekly earnings).

- Guaranteed issue with minimum group participation.

- At least 90 days of service with ACE Mfr required for eligibility.

Pre-existing conditions: In the first 12 months after the effective date, if a disability results from a pre-existing condition within 12 months prior to the effective date, it will not be covered unless qualifying prior coverage existed.

Pays the selected weekly income for non-occupational illness or injury.

Extensive nationwide provider network of convenient, accessible options for eye care offered through the EyeMed Vision Care (www.eyemedvisioncare.com).

- Access to more than 35,000 vision care providers at 18,000 locations nationwide.

- Includes Optometrists, Ophthalmologists, Opticians.

- Many leading optical retailers, incl. LensCrafters, Target, Sears, Pearle locations.

- Evening and weekend hours at many locations.

- No appointment necessary.

- Choice of thousands of fashionable, designer frames.

- Unlimited additional discounts up to 40% off after the funded eyewear benefit is used.

- 20% discount on all items not fully covered.

- Laser vision correction savings of 15% off retail or 5% off promotional price nationwide.

- Replacement contact lenses by mail program gives members great prices on contacts & home delivery.

A comprehensive plan that gives members a paid-in-full exam, contact lens fitting and follow-up, and allowances for eyewear such as frames and lenses ($130) and contact lenses ($120), plus substantial discounts for other eyewear options.

V I S I O N S E L E C T P L A N

and

to Submit your

benefit selections from Step 1 above (may take 10 seconds)

► Purchase low cost Group Life Insurance to protect your loved ones in the event of your premature death. There are many reasons to have life insurance: Mortgage or other debt protection, college funding, to provide an income for your dependents, final expenses, charitable gifts, and more.

You may also purchase low cost coverage on your spouse and/or your children.

► Short Term Disability insurance (STD) pays you a portion of your lost income while you are out of work due to an illness or injury, as well as when you are recovering.

Statistics show that the majority of American families would be bankrupt if they missed more than three consecutive paychecks. And 48% of all home foreclosures are as a result of a disability. According to the Council for Disability Awareness, 30% of those in the workforce will experience a disability of some kind before they retire.

► Dental care can be very expensive. Those who don't have insurance are forced to do without dental check ups and treatments because of the cost. They eventually go to the dentist when the problem gets too painful to bear, and often, the damage is so great that more expensive and intrusive treatments become necessary.

You can avoid this situation and enjoy healthy teeth and gums by getting dental insurance.

► Vision insurance is a wellness benefit designed to reduce your costs for routine, preventive eye care such as eye exams, eyewear and other services.

In addition to screening for visual impairment and correction, routine exams can detect serious illnesses which may otherwise go undetected, such as diabetes, high blood pressure, glaucoma, and more.

Dental

BI-WEEKLY PAYROLL DEDUCTION:

Employee only.........$ 8.37

Employee & Spouse.....$24.41

Employee & Children...$29.75

Employee & Family.....$35.78

DEMO

ADDITIONAL FEATURES

DEMO VERSION

DEMO VERSION

DEMO VERSION

Long Term Disability

BI-WEEKLY PAYROLL DEDUCTION:

Use the calculator below to determine your

monthly benefit and bi-weekly deduction.

1 Review and select the following benefits:

Life Insurance BENEFIT FEATURES :

- Premium is Waived in the event of disability (to Age 65).

- Accelerated Death Benefit: Terminally ill employees may access up to 75% of their benefit (to $100k) ).

- Portability Provision: May continue coverage upon termination of employment at same group rates.

- Conversion Privilege: May convert to permanent plan of insurance.

- EMPLOYEE COVERAGE:

- May select from $10,000 to the lesser of 7 times your annual salary or $500,000.

- Up to $100,000 is guaranteed issue (amounts in excess of $100,000 are subject to limited underwriting).

- SPOUSE COVERAGE:

- May select up to half of the employee amount, to $150,000

- Up to $25,000 is guaranteed issue.

- CHILDREN COVERAGE: (Available to Children Under Age 19 for employees Under Age 55)

- $ 10,000 on each child over the age of 6 months (guaranteed issue).

- Benefit continues through child's Age 26, and may be converted to permanent plan.

Level death benefit to Age 65. Reduces to 65% at the employee's Age 65, reduces to 50% of the original amount at Age 70, to 35% at Age 75, to 20% at Age 80, and terminates at the employee's retirement, whichever occurs first.

To learn about and enroll in our new voluntary benefit plans....

Long Term Disability BENEFIT FEATURES :

-- Elimination Period. An insured does not have to be totally disabled throughout the elimination period

to qualify for benefits. A combination of total and/or partial disability days will satisfy the requirement

-- Mental Illness & Substance Abuse: Up to 24 months lifetime.

-- Temporary Recovery: No new elimination period when an employee returns to work for fewer than six

months and is disabled again due to the same or related causes.

-- Vocational Rehab Services: A disabled employee receiving payment may be eligible for vocational

rehabilitation services.

-- Lump sum survivor benefit. Pays lump sum (3 x payment) to an eligible survivor.

Pays a disabled employee 60% of pre-disability income (up to $6,000/month).

► Long Term Disability Income (LTD) insurance covers employees who become unable to work for a long period of time as a result of an injury or sickness beginning after the elimination period. Disability benefits are designed to partially replace the income a disabled employee would have earned had he or she been able to continue working.

But it's more than insurance against illness or injury, it's protection against loss of your hard earned assets.

Preventive Care (100%):

- Routine exams and cleanings (two per 12 months)

- Fluoride treatment for children under age 19 (one per 12 months)

- Bitewing X-rays (one per 12 months)

- Emergency treatment for dental pain (minor procedures)

Basic Services (80%):

- Simple restorative services (fillings)

- Simple teeth removal

- Sealants for children ages 6 through 15 (one per tooth per 36 months)

- X-Rays (full mouth or panorex, one per 36 months)

- X-Rays of the rotts of teeth

Major Services (50%): (12 Mo Waiting period, waived if prior qualifying cvg)

- Endodontics (includes root canals)

- Periodontics

- Surgical teeth removal and other oral surgery

- Medically restorative services (crowns and inlays)

- Dental Implants (age 17 and up)

- Prosthodontics (bridges, dentures)

- Denture relines (if over six months after installation)

- Recementation and repair of crowns, inlays, bridges and dentures

Orthodontia Services:

- No deductible, 50% coverage

- $1,000 lifetime maximum

- Children under 19 only

- 12-month waiting period

With the "Premier" Group Dental plan, employees and their dependents may visit any dentist of their choice without restriction.

Policyholders have the freedom to select any dentist, however, those who visit a DenteMaxdentist will save money! DenteMax dentists have agreed to accept as payment in full a discounted fixed fee schedule for the services they perform and will never collect more than the DenteMax fee for the procedure performed -- no "balance billing." Find a DenteMax dental provider in your area.

► All services except Orthodontia are subject to a combined $100 "lifetime" deductible

► Annual maximum benefit per person: $1,000.

P R E M I E R P L A N

Dental Insurance BENEFIT FEATURES :

- Benefits start after 90 days of disability, and continue until Age 65.

- Maternity is treated as we would an illness.

- Premium Waiver: We will waive premiums while we are paying benefits

- Continuity of Coverage: An employee receiving benefits will not lose coverage if the employer

changes carriers.

- Cost of Living Freeze: Once we establish a gross disability payment, we will not reduce it due to cost

of living increases from other income sources, except for increases in income from employment.

- Definition of Disability: -- "Own Occupation" during the 90 day waiting period. -- "Own Occupation" for the 24 mos. following the waiting period.

-- "Any Occupation" thereafter.

Additional features:

CHILDREN: $ .37 total - $10,000 benefit on each child

Age Age Age Age Age Age Age Age Age Age Age

Face Amt 15-29 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75-79

-------- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- -----

$ 5,000 $ .17 $ .24 $ .27 $ .31 $ .42 $ .62 $ 1.13 $ 1.71 $ 3.25 $ 4.77 $ 6.28

$ 10,000 .33 .47 .53 .62 .83 1.24 2.25 3.42 6.51 9.55 12.55

$ 25,000 .65 .97 1.06 1.15 1.66 2.49 4.52 6.83 13.02 18.99 23.32

$ 35,000 .72 .99 1.40 1.43 1.61 3.50 4.50 8.07 18.20 21.00 25.20

$ 50,000 1.29 1.94 2.12 2.31 3.32 4.98 9.05 13.66 26.03 29.88 35.87

$ 75,000 1.94 2.91 3.18 3.46 4.98 7.48 13.57 20.49 39.05 33.54 43.55

$100,000 3.23 4.85 5.31 5.77 8.31 12.46 22.62 34.15 65.08 69.44 79.09

$150,000 3.88 5.82 6.37 6.92 9.97 14.95 27.14 40.98 78.09 81.23 91.33

$200,000 4.52 6.78 7.43 8.08 11.63 17.45 31.66 47.82 91.11 94.77 89.55

$250,000 5.17 7.75 8.49 9.23 13.29 19.94 36.18 54.65 104.12 108.45 118.44

$300,000 5.82 8.72 9.55 10.38 14.95 22.43 40.71 61.48 117.14 122.95 132.22

$350,000 6.46 9.69 10.62 11.54 16.62 24.92 45.23 68.31 130.15 137.99 147.12

$400,000 7.11 10.66 11.68 12.69 18.28 27.42 49.75 75.14 143.17 148.45 158.45

$450,000 7.75 11.63 12.74 13.85 19.94 29.91 54.28 81.97 156.18 164.67 176.08

$500,000 8.40 12.60 13.80 15.00 21.60 32.40 58.80 88.80 169.20 175.94 189.12

E N R O L L ?

E N R O L L ?

E N R O L L ?